How GTM Efficiency Affects IPO Readiness

Lean Revenue Production in a Post-GAAC World

By Dave Boyce and Jacco van der Kooij of Winning by Design

with the data sourced by David Spitz of BenchSights

If you are waiting for a SaaS recovery, prepare to wait a long time. No industry-wide recovery is coming soon. The SaaS industry is evolving and maturing, and current performance is bifurcated: 31 out of 72 public SaaS companies are thriving, while the rest are struggling. The market that rewarded "Growth at All Cost" (GAAC) shifted dramatically in late 2021, impacting all SaaS companies. Those companies continuing to pursue GAAC strategies and tactics are seeing worsening results. Since January 2022, SaaS growth rates have halved, while acquisition costs of Incremental ARR1 have nearly doubled, as we reported earlier.2 This trend is evident among the 72 public SaaS companies and most private companies with revenues over $50M in ARR–most notably for the dozens of companies preparing for IPO in the next 24 months.

The #1 issue for CEOs today is the continued decline in GTM performance.

1. GTM Performance

To assess GTM performance, we analyzed 72 public SaaS companies using a simple factor called GTM Efficiency. It is calculated as the total sales and marketing spending ratio to Net New ARR.

Simply put, a GTM Efficiency Factor of 100% means it takes $1 in marketing and sales costs to acquire $1 in incremental ARR. According to this measure, companies in the top 10% operate at a GTM Efficiency of less than 100%. Due to high gross margins, some companies can sustain a slightly higher GTM Efficiency Factor, but 100% is the benchmark. If a company experiences more than six quarters of GTM Efficiency exceeding 200%, and this trend continues to rise, management must recognize that their model has become unsustainable.

Figure 1. GTM Efficiency for the Least Efficient SaaS Companies

Companies at the bottom of our ranking have GTM Efficiency between 200% and 500%, putting several of them in definitive danger. For 31 of the 72 analyzed companies, GTM Efficiency is worsening as they continue to overpay for growth beyond the sustainability threshold. At the top of our rankings, ten successful SaaS companies have GTM Efficiency below 100%, with some trending even better, proving that efficient GTM can be accomplished.

Figure 2. GTM Efficiency for the Most Efficient SaaS Companies

This raises questions: What strategies are working for highly efficient companies, and what is failing for the least efficient ones? How can a high-performing SaaS company return to growth without spending $3, $4, or even $5 in Sales and Marketing for each $1 in Incremental ARR? To create GTM efficiency, we must look at how revenue is acquired, maintained, and expanded. In a post-GAAC world, revenue leaders should pay attention to each process, each ratio, and each metric. In this sense, revenue production begins to look like factory production.

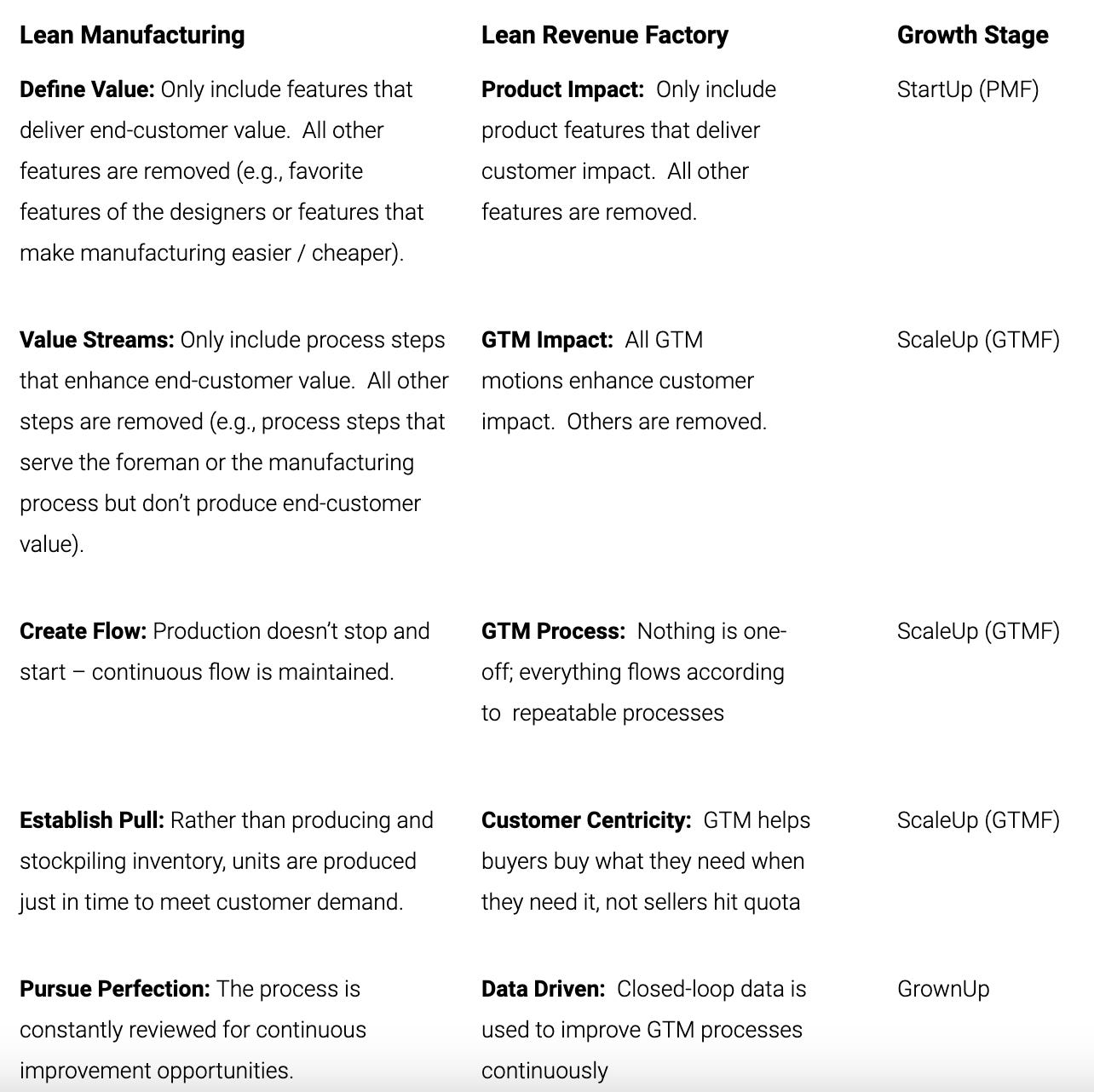

2. The Lean Revenue Factory

We are introducing a simple concept: To operate a recurring revenue business as if it were a factory, a Lean Revenue Factory, and see each GTM motion as a revenue production line. This approach draws inspiration from the best practices of the Industrial Revolution, and it customizes them to suit to the distinctive needs of recurring revenue businesses (See Table 1).

Table 1. The goals of a recurring revenue factory match those of a physical factory.

Through this lens, it becomes easy to analyze each line, measure the inputs, throughput, and output, and optimize the processes to achieve the desired results. The factory analogy works on several levels:

The process defines how work moves through a Lean Revenue Factory.

GTM motions operate much like production lines in a factory, with each motion incrementally improved based on metrics.

AI augments or replaces human skills in each production line, the same way robots do on physical factory floors.

Any recurring revenue business with over $10M in ARR, a solid PMF, and a sufficiently large TAM can be analyzed and optimized using lean production as an analogy. To better understand the principles of lean revenue production, we take lessons from manufacturing, where lean processes changed the industry forever.

Figure 3. In a Lean Revenue Factory, each GTM motion is treated like its own revenue production line

We have established the problem: GTM Efficiency is declining for many SaaS companies. This decline threatens the success of many SaaS companies if they do not abandon GAAC's failed tactics. In the following sections, we draw parallels between physical manufacturing and revenue production, taking lessons from the lean revolution that apply directly to revenue. From there, we outline the core principles of lean revenue production and describe the steps in building a Lean Revenue Factory.

3. From Craft to Mass to Lean Manufacturing

There are three steps from Craft to Lean Manufacturing:

Step 1. Craft Manufacturing: The earliest assembly lines were run by artisans whose considerable skill and knowledge were invested in every finished good that came off the line. This one-at-a-time Craft Manufacturing approach was the only option until the development of Mass Manufacturing in the late 19th and early 20th century.

Step 2. Mass Manufacturing: Each part is produced to a standard specification and assembled according to a defined process. Workers followed the process and assembled parts with minimal customization. Mass Manufacturing improved predictability, lowered costs, and improved quality. Most factories in the 20th century operated according to Mass Manufacturing principles.

Step 3. Lean Manufacturing: Lean Manufacturing was developed in the mid-20th century as a formal alternative to mass manufacturing. It is not about maximizing throughput–it is about optimizing processes. Lean principles focus on precision and rely on data and closed-loop information to continuously improve processes.

The five fundamental principles of Lean Manufacturing are:

Principle 1. Define Value: Only include features that deliver end-customer value. All other features are removed (e.g., favorite features of the designers or features that make manufacturing easier / cheaper).

Principle 2. Value Streams: Only include process steps that enhance end-customer value. All other steps are removed (e.g., process steps that serve the foreman or the manufacturing process but don’t produce end-customer value).

Principle 3. Create Flow: Production doesn’t stop and start – continuous flow is maintained.

Principle 4. Establish Pull: Rather than producing and stockpiling inventory, units are produced just in time to meet customer demand.

Principle 5. Pursue Perfection: The process is constantly reviewed for continuous improvement opportunities.

Toyota was the poster example of Lean Manufacturing in the auto industry. Toyota’s techniques defined the conventional norms of Mass Manufacturing. Mass manufacturers had tooled and automated their factories for maximum throughput but sacrificed flexibility. In the 1990s, Ford Motor Company needed to re-tool a production line to produce a new model, which took six weeks. For Toyota, it took a few hours. Ford produced and pre-sold inventory through its dealer networks, resulting in sales and discounts to clear out models and make room for new ones. Toyota produced inventory just in time, according to customer demand.

The Toyota Production System (TPS) was so effective that it forced the entire industry to reconsider its mass manufacturing approaches. Some producers followed quickly: Honda, Nissan, and GM, for example. Others took their time but eventually adapted: Ford and Chrysler. Still others never switched from Mass to Lean manufacturing and went out of business: AMC, Studebaker, DeLorean, and Hudson, to name a few.

Today, we see a similar shift in revenue production: Sales was once the exclusive domain of skilled artisans. This evolved into mass revenue production, with processes and systems built to maximize throughput. In almost all cases, this led to GAAC. We now see the evolution of lean revenue production defining success in the post-GAAC era.

4. Mass Revenue Production in the Golden Age of SaaS

In the early years of SaaS, revenue leaders, and GTM software providers attempted to speed up the revenue generation. Since growth was the primary (and sometimes sole) objective, anything that could be done to accelerate growth (at any cost) was deemed a good thing. Leaders began applying principles of Mass Manufacturing to squeeze more results out of their operations:

Use of low-cost labor: SDRs increased the velocity of prospecting via outbound calls and emails.

Marketing automation tools: Tools such as Marketo, Eloqua, Pardot, and ExactTarget increased the throughput and velocity of marketing emails.

Power dialers and predictive dialers: Tools such as InsideSales, Genesys, and Five9 increased the velocity of outbound sales calls.

Cadence tools: Tools like Outreach, SalesLoft, and InsideSales customized sales emails and calls on a large scale.

Entire methodologies were developed, and books were written that applied principles of mass manufacturing to sales. The book Predictable Revenue is a prime example of this line of thinking.3 Most mass revenue generation methodologies relied on simple funnel math: more activity at the top of the funnel results in more opportunities and more closed-won business (see Figure 4).

Figure 4. Mass Revenue Production relied on volume, calling for more top-of-funnel activity to produce more bottom-of- funnel revenue. This is similar to Mass Manufacturing, which built heavy automation to increase throughput at the expense of flexibility.

As companies looked to amplify prospecting efforts, the deployment of SDRs, BDRs, and ISRs became a popular way to widen the top of the funnel by increasing the volume of prospecting phone calls and emails at a reasonable cost. Tools like power dialers and cadence tools allowed one SDR to do the work of several, decreasing the cost-per-lead but increasing the amount of spam launched into the market. Aggregate efforts to increase throughput via mass production techniques produced what, in hindsight, is a logical result. The market was saturated, and buyers became “immune” to cold calls, cold emails, cadences, and even beautiful, customized emails generated by AI.

Despite the promise of growing top-of-funnel volume to produce more bottom-of-funnel results, this “predictable revenue” began to fall off as the quality of leads declined and the conversion rates from calls to meetings to demos fell. Because investors during these years were more interested in growth rate than efficiency, we ended up in an ‘inefficiency spiral’ in which more leads (inputs) cost more money, and more leads converting at lower rates cost even more money.

Figure 5. When growth is valued above all other considerations, declining conversion rates can put upward pressure on inputs and the cost of those inputs, creating an Inefficiency Spiral

When GAAC was the order of the day, the human labor required to keep this spiral going was in high demand, and compensation packages for salespeople of all sorts—especially SDRs and BDRs— became astronomically high. Some markets began paying BDRs $100K when they only produced $1.5M of pipeline, which converted to less than $100K of closed-won business. When you combine the cost of BDRs with the cost of lead generation, salespeople, and sales management, it is easy to see how we began spending $3, $4, and even $5 for every $1 of incremental ARR. This trend continues today (see Figure 1). With it, mass manufacturing revenue became undeniably unsustainable.

5. The Advantages of Lean Revenue Production

Lean revenue production is not one-size-fits-all. It focuses on efficient, sustainable growth rather than pursuing growth at all costs. Just as Toyota tailors its production and processes to the needs of the customer segments it serves, lean revenue processes are designed and managed one segment at a time. Closed-loop data refines this approach, and the entire operation is managed like a factory.

To understand the advantages of lean revenue production, we must examine how growth works in a recurring revenue world. Revenue growth for recurring revenue businesses follows a predictable pattern: Product-Market Fit (PMF) is the first objective, Go-To-Market Fit (GTMF) is the second, and efficient and repeatable scaling is the ultimate result of carefully building a revenue factory. Each of these stages requires iteration and continuous improvement.

This iteration is unique to each GTM motion, as the processes for the SMB segment differ from those for the mid-market and Enterprise segments. Despite these differences, measurement can be consistent. Each GTM motion has its inputs (leads), throughput (conversion rates), and output (ARR). We can measure these processes for different GTMs using a standardized data model.

Figure 6. Lean Revenue Production follows a predictable growth trajectory, marked by essential milestones (breakpoints) that enable progression to the next phase. The GAAC approach prioritized velocity at the expense of establishing these critical milestones.

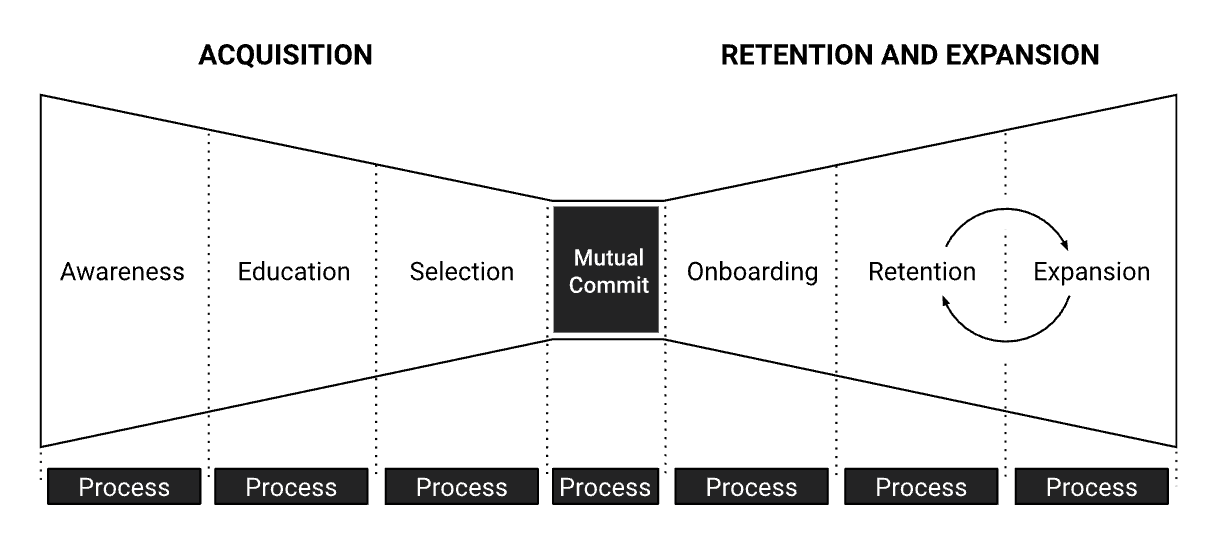

6. The Bowtie: A Standardized Data Model

Imagine you report GTM results to shareholders, including revenue retention of 89%.

“That’s terrible,” one shareholder says. “My other portfolio companies have over 95% retention.”

“That’s incredible,” says another. “What are you doing to retain at such a high level?”

As it turns out, both shareholders are right. 89% is just under where you would want to be if you served customers in the enterprise segment. Simultaneously, it is far above the benchmark for a self-service segment. So, whether 89% is good or bad depends on which segment is being measured. And if the “89% retention” represents an “average” across multiple segments, what can it tell us about what’s going well and what’s not in each segment?

Furthermore, are we talking about usage retention, revenue retention, client retention, gross retention, or net retention? Monthly or annual? To ensure we speak the same language, we need a GTM Data Model that extends from initial customer awareness through renewal and expansion.

Figure 7. A singular Data Model that spans all of GTM, from awareness through expansion, can measure the inputs, throughput, and outputs of each distinct GTM motion.

With stages of the customer journey defined and conversion rates standardized from one stage to the next, we are ready to be specific about metrics. We can now measure one GTM independently of another, compare it to its appropriate peer set, and not get confused by “average” performance. For instance,

When looking at Enterprise GTM, we may not be concerned about a customer acquisition cost (CAC) of over $50K. However, we are concerned about less than 80% gross revenue retention.

For a self-service GTM, the opposite would be true. We may need a CAC of <$100 and be perfectly happy with a gross revenue retention of 70%.

The Data Model allows us to measure and monitor each GTM as its revenue production line.

7. GTM Process

How does a customer move from awareness to education to selection, renewal, and expansion? Facilitating this journey requires certain processes by marketing, sales, customer success, and account management teams. These processes need to be defined and documented in lean production.

"If you can't describe what you are doing as a process, you don't know what you're doing.” - W. Edwards Deming.

When a certain process delivers suboptimal results, we can adjust it to see if we can achieve better results. This iterative process defines the growth stage wherein we seek GTM Fit: the ScaleUp phase.

Figure 8. The throughput for each customer journey stage results from processes defined and executed for that stage.

Since each GTM is its own system, this iteration happens one GTM at a time. Improvements are made to individual processes and steps, with measurements taken for the results of that step and the system overall. Since GTMs operate as systems, each step can affect the others. Better leads in the front end have positive downstream consequences. Worse onboarding processes have negative downstream consequences. Measuring the results of each system component and the aggregate output allows us to aim for improvement efforts where they are needed.

Each improvement is best approached as an experiment. If the proposed improvement to the process delivers favorable results, it can be rolled out in a more permanent way. If the results are undesirable, the experiment fails, and we look to the following process iteration for better results.

Case Study:

A firm serving the SMB segment has a process whereby inbound leads are directed to schedule an appointment for a customized product demo.

The “schedule a demo” CTA (call to action) is not producing the desired results. What if we tried making an interactive demo available to prospects on a self-service basis?

Building a self-service demo is expensive, so the company changed the CTA from “schedule a demo” to “see it in action” even before building a new, self-service demo. Since this is a GTM experiment, the company is willing to approximate the experience of the self-service demo (“hold it down”) and see if the conversion rates improve. When prospects click “see it in action,” they are directed to a live experience with a human who delivers a somewhat canned demonstration.

Conversion rates are now much higher, but the company knows this may be a false positive. Given the positive movement, however, the company decided to record a video walk-through of the product (still not a self-service demo) and see if that experience performs better than “schedule a demo.” Only once the company is convinced that a self-service, interactive demo can deliver sufficiently improved results do they invest the time and expense to build an interactive demo (“bolt it down.”) In another version of this story, the company may find that the pre-recorded video walk-through performs so well that they don’t need an interactive demo.

In the Lean Revenue Factory, each production line (GTM) is optimized via a series of experiments like the one described above:

What is the optimal qualification process?

What is the optimal discovery process?

What is the optimal negotiation process?

What is the optimal onboarding process?

And so on, and so forth

Tuning a single production line (GTM motion) can take months, and the metrics demonstrating success are readily visible in the data model. Once a GTM works predictably, the company can move on to the ScaleUp phase, where more money and resources are poured into an already-defined-and-tuned GTM motion that delivers predictable results.

8. Fixing Problems in a Lean Revenue Factory

What happens if a portion of the production line begins to falter? This happens all the time in the Toyota Production System. Because lean manufacturing depends on continuous flow (see the principles of Lean Production above), you might think the team would be required to keep the production line running while they work on the problem. The opposite is true.

In TPS, if a portion of the process begins to falter, then principle 5 (Perfection) trumps. When a failure is detected, the production line is stopped. Each worker in a TPS factory has a cord above their head called the “Andon Cord,” installed for just such an occasion. Pulling the cord stops the production line for everyone. If a worker spots a problem, she pulls the cord and stops the line. This gets everyone's attention on the factory floor. All focus is dedicated to the error, and its origin is pursued as far up the production line as necessary until the root cause is discovered and remedied. The theory is that if we have zero tolerance for imperfection, we will take the time to fix things as they occur, and defect rates will all but disappear.

In manufacturing, this is how quality reaches “five 9s,” or 99.999% defect-free output. In GTM, we have a similar decision to make. When metrics deviate from target somewhere along the Bowtie, do we keep things running or “stop the presses” and address the issue?

Case Study (continued)

Continuing the hypothetical example from above, let’s consider the following scenario.

The sales team is initially pleased with the results of the new self-service demo. Lead flow has never been so robust, and they are exceeding quota. Revenue Operations is also happy about the pipeline and close rate resulting from the new demo.

Three months later, a concerning metric emerges. The percentage of new customers successfully onboarded is falling (CR6 in the Bowtie Data Model). The number of new customers successfully achieving First Impact is still growing, but the percentage (conversion rate) has fallen precipitously. Since revenue growth hasn’t slowed, the CRO did not notice this anomaly until the head of Rev Ops pointed it out. “I wonder what’s happening here?” she says. “Let’s investigate.”

The investigation reveals that the total number of new customers has grown dramatically, but the size of those customers is much smaller. The current onboarding process does not serve smaller customers well, and many new customers who are not succeeding are on the small end of the distribution.

“Why all the small customers all of a sudden?”

“Oh! It’s because we let anyone experience the interactive demo. Salespeople are happy to sell to anyone, so now we have a larger flow of smaller customers and haven’t adjusted our onboarding accordingly.”

In this scenario, the company could accept the higher volume of smaller companies as the “new reality” and wait to see what other systemic impacts this has. Management could explicitly decide not to adjust the current process, which produces more volume at a lower onboarding success rate. Or they could investigate how to adjust their processes. The adjustments could include a) tightening the qualification process and b) improving the onboarding process.

If the company decides to ignore it, it may see a real revenue impact beginning 12 months from the launch of the interactive demo. Why? Customers who have never made an impact with the solution will churn. If, on the other hand, the company picks up these signals, treats them as leading indicators, and follows the principle of continuous improvement, it can avoid things like the “first birthday surprise” of a mass exodus 12 months after launching its new process.

Using data to identify and remedy issues on an ongoing basis is a core underlying tenet of Lean Manufacturing. It’s popularly known as Continuous Improvement or Kaizen, and it can be just as effectively applied to lean revenue production.

9. GTM Differentiation

Each GTM motion requires its own unique processes to deliver expected results specific to the segment it serves. The processes that work well for a No-touch (PLG) motion would not work for a Dedicated-touch (ABS) motion, and vice versa.

Figure 9. Each GTM serves a specific customer set, with a specific ACV, according to a specific set of processes that align with the customer's preferences and the company’s unit economics

Once a company has optimized a single GTM motion via a series of iterations and experiments, it may make sense to launch a second GTM. Of course, this GTM will require a distinct set of processes and measurements, but it can be codified within the same data model.

Assuming our first GTM was Medium-Touch Inbound (~$10,000+ ACV, according to the chart above), what happens if we want to go to Low-Touch PLS? In our case example, the first step was taken when we launched an interactive demo. PLS, or product-led sales, might take that a step further and offer a prospect the opportunity to create an account and begin using the product for free (not just a demo). Salespeople would then interact with specific customers deemed to have a high conversion probability, and we would measure the effectiveness of this motion.

Which customers warrant sales assistance?

Which customers could stay on the “self-service happy path” and monetize without assistance?

What is the sales playbook when engaging with a current user of the product rather than someone who has just seen a demo?

We must answer these questions as we design, test, and iterate on GTM motion #2.

In a lean revenue production world, each GTM is treated as its own production line. Each line is optimized to produce desirable outputs using repeatable processes. We measure and monitor input, throughput, and output and are careful to only make things permanent once we know what works.

10. The role of AI in GTM

In a world of Lean Revenue Production, what is AI's role? Will AI replace human labor? Can AI help improve our GTM efficiency and effectiveness? Will it be AI + humans in the future? A kind of “human-in-the-loop” AI situation? We believe AI can help GTM in 2 ways:

Prioritize work for humans

Automate repetitive or mundane tasks

Functions of AI

AI comes in various shapes and forms. Machine learning, computer vision, decision support systems, natural language processing, and robotics can all be considered forms of artificial intelligence. We invite you to consider two functions of artificial intelligence that are relevant to GTM:

Predictive AI: Uses machine learning to recognize patterns, learn from them, and apply that learning to predict future outcomes. Predictive AI can point to future probable outcomes or indicate actions that can be taken now to improve future performance. In GTM, Predictive AI is used to predict churn, qualify pipeline, recommend actions to a sales rep, and formulate forecasts.

Automation: Used to do what a human would otherwise do. Think robot. Can AI fill in CRM fields? Take meeting notes? Build a task list? Write an email? Build a campaign? Launch a phone call? Guide an onboarding process? Teach a training cohort? Process a renewal? Of course, it can—and it should!

In GTM, AI has two jobs:

Help reps focus on the right things using Predictive AI

Perform mundane tasks using automation

Now that AI can predict the future, recommend actions that will improve the future, and then take those actions on its own, all our GTM problems are solved, right?

Of course not.

Why? Because process comes first.4

If you haven’t perfected your process, the most elegant robot–doing things faster or better–will not improve outcomes. All the testing and experimentation we deployed while iterating our way to GTMF was intended to perfect the process. We determined what steps, in what order, performed in what way would produce the best outcomes. First, we prototyped, then tested, and when we were confident we had something that worked, we committed it to a process we could repeat with predictable results.

This process–the one that is optimized–may be eligible for optimization or automation via AI. If we are confident it is the right process, why not get a robot to do it for us? If the task lends itself to automation, that is the right thing to do. Now, we can do more efficiently what we already know works. The proven process is automated, and humans are freed up to work on higher-order tasks.

Predictive AI can also help, but instead of automating steps in a process, it helps identify conditions that require attention and prioritize our efforts.

Which opportunities are most likely to close?

Which deals require immediate attention?

Which clients require immediate attention?

Which prospects are likely ready to take the next step?

Adding AI to your Revenue Factory

Below, we discuss the steps of building a Lean Revenue Factory. As we have seen, a Lean Revenue Factory relies on well-defined processes that deliver reliable results. It uses closed-loop feedback, delivered via a standardized data model, to make continuous updates and improvements.

We must first build this factory to get the most out of AI. Once the factory is in place, AI can help prioritize and automate work. Before the factory is in place, deploying AI would be like introducing a robot to a Craft Manufacturing process. The robot wouldn’t know what to do, and the craftsman would not need it.

Process first, AI second.

Heavy automation did not help Ford Motor Company beat Toyota in the 1990s. Ford had robots and automation, and they could crank lots of volume through their assembly plants. However, until Ford Motor Company applied the principles of lean manufacturing, this automation actually slowed them down and made them less responsive. Toyota, who deployed automation only when and where it made sense, outperformed Ford and every other mass manufacturer–until some adopted lean manufacturing principles.

Today’s SaaS companies establishing the Lean Revenue Factory will discover areas where AI-driven prioritization (predictive AI) and automation (including generative AI) can help, not hurt. Prioritization will help improve conversion rates by directing human effort to the areas with the highest impact. Automation will free humans from mundane tasks, allowing them to focus on the highest and best return activities. Automation has the added advantage of trending the marginal cost of revenue acquisition, maintenance, and expansion toward zero, freeing up capital that can be invested in strategic priorities.

11. How to Build a Lean Revenue Factory

The steps for turning your GTM operation into a Lean Revenue Factory are straightforward. Yes, they take time and effort–but the effort pays dividends at every step.

Step 1: Install a data model across your entire GTM

Step 2: Divide your business into distinct GTMs or production lines

Step 3: Measure each GTM independently

Step 4: Define your current-state processes for each GTM

Step 5: Using industry benchmarks and unit economics as your guide, identify opportunities to improve results at various points in the process

Step 6: Experiment with new approaches to problem areas until you find processes that work

Step 7: Standardize these new processes–first via training and measurement and then (if possible) via automation

Step 8: Monitor your system continuously for improvement opportunities

At Winning by Design, we have worked on over 1,000 Revenue Factories. In some cases, that work has been defined as process improvement. Sometimes, we’ve worked with teams to execute specific steps reliably. Often, we work on installing a data model and visibility across the GTM system. Occasionally, we have had the privilege of building an entire Lean Revenue Factory, working shoulder-to-shoulder with an industry-leading team–often in preparation for an IPO.

When optimizing a SaaS GTM operation, we have found it most helpful to visualize a factory and adopt lean manufacturing principles. The five principles of Lean Manufacturing are presented below, along with their SaaS translations (see Table 2).

Table 2: Lean Manufacturing Principles Applied to the Lean Revenue Factory

Product Impact is the north star as we pursue PMF during the Start-up phase. Moving from the Start-up phase (PMF) to the Scale-up phase (GTMF), we work on GTM Impact, GTM Process, Customer Centricity, and Data-driven continuous improvement. These are all aspects of a well-tuned GTM engine, and we apply them one GTM motion (production line) at a time, as outlined above.

12. In Conclusion

The SaaS industry is shifting away from the unsustainable "growth at all costs" model. Our research underscores the critical importance of GTM Efficiency in driving long-term success. By applying Lean Manufacturing principles to revenue production, SaaS companies can optimize operations, reduce costs, and improve customer satisfaction.

Transitioning to a Lean Revenue Factory requires a cultural shift, a focus on data-driven decision-making, and a commitment to continuous improvement. While the journey may be challenging, the potential rewards—increased efficiency, profitability, and customer loyalty— are substantial. By embracing these principles, SaaS companies can survive and thrive in the evolving market landscape.

The future belongs to those who prioritize Product Innovation and GTM Efficiency.

Incremental ARR includes all new sales and expansion sales, net of all downsells and attrition.

Has SaaS lost Go-To-Market Fit and what to do about it. February 2024, By Jacco vanderKooij and David Boyce

Predictable Revenue by Aaron Ross and Marylou Tyler

Back to the Future: Process First, AI Second, Jacco van der Kooij

Your analysis is informative and leading-edge. But it seems that your examples of inefficient GTM strategies are moreso examples of markets becoming commoditized. These companies' products are no longer as compelling as they once were, so they have to fight harder to sell anything. Their target markets (TAM) are drying up at the same time that their (lack of) innovation is bearing itself out within their product suites. Am I wrong?